The Arrived Single Family Residential Fund was launched in Q4 2023 to provide investors with an easy way to invest in a portfolio of single family residential properties. We believe this asset class has solid fundamentals and long-term growth potential, making it an attractive investment opportunity.

Investing in the Arrived Single Family Residential Fund offers investors instant exposure to several hand-selected properties in markets nationwide. The Fund is structured as a private real estate investment trust (REIT) managed by Arrived.

Investment Strategy

We believe the single family residential market is a compelling investment for a few reasons. It is a vast market — over 100 million in the US alone — worth more than $30 trillion. It is also driven by many positive factors, such as population growth, job growth, and rising incomes. And because it's not dominated by just a few big players, there are chances for investors to buy properties at reasonable prices.

To achieve our investment goals, we focus on two primary objectives: providing investors with a steady income stream and offering the potential for long-term asset appreciation. We do this by acquiring single family rental properties in dynamic markets with significant growth potential. We also aim to increase property value over time through efficient property management and fostering positive relationships with long-term renters.

Specifically, our approach entails:

Investment Objectives

Our investment objectives are to provide consistent cash flow and pursue long-term capital appreciation. We achieve these goals through a strategy of moderate leverage, wherein we carefully utilize borrowing to acquire properties while maintaining balanced debt levels relative to asset values. This approach can enable us to generate reliable income streams from our investments while aiming for sustained asset value growth. Additionally, we prioritize optimizing returns through favorable tax treatment of REIT income and long-term capital gains.

Responsible risk management is central to our investment strategy, focusing on capital preservation alongside growth objectives. We recognize the importance of shielding investors' capital from undue risks while striving to achieve attractive returns over time. By carefully balancing risk and return, we aim to offer an investment opportunity that provides both steady income and the potential for long-term wealth accumulation.

Market Criteria

In selecting markets for the Arrived Single Family Residential Fund, we prioritize areas that meet specific criteria conducive to sustainable growth and profitability. Our focus centers on the top 200 Metropolitan Statistical Areas (MSAs) to target regions with robust economic activity and growth potential. We seek markets with sufficient inventory to support scalability, which is defined as having at least 50 homes available for acquisition, allowing us to build a substantial presence and operational efficiency within the local market.

Additionally, we assess the market's job and income growth forecasts, prioritizing regions experiencing positive trends in these areas. Affordability is another critical factor, with a focus on markets where the gross rent multiplier is below 15, indicating a reasonable ratio between the price of homes and their rental income potential. We consider the presence of a large, skilled workforce and increasing demand for housing units to ensure sustained rental demand. We also evaluate the competitive landscape, favoring markets where competition from other buyers is manageable.

To ensure proper diversification and mitigate concentration risk after we have raised at least $20 million of net offering proceeds, we do not intend to invest more than 25% of our net offering proceeds in any particular MSA.

Market Commentary and Outlook

The single family residential market has remained resilient even amidst challenges like high mortgage rates and persistent inflation. As rates are forecasted to remain high, we’re focusing on specific markets, predominantly in the Southeast, that exhibit fundamental characteristics necessary for growth.

The new home market continues to be attractive due to the interest lock-in effect constraining resale supply. A low supply of construction labor and high material costs steer our acquisition strategy towards new homes in an effort to minimize future spend on the investments. We find compelling value in new neighborhoods that are on the path of progress as cities expand.

As we approach the high leasing season, the industry forecasts project a promising outlook, with expectations of 3% or more rent growth for 2024. Our rental strategy focuses on 2-year leases with term expirations in the spring months.

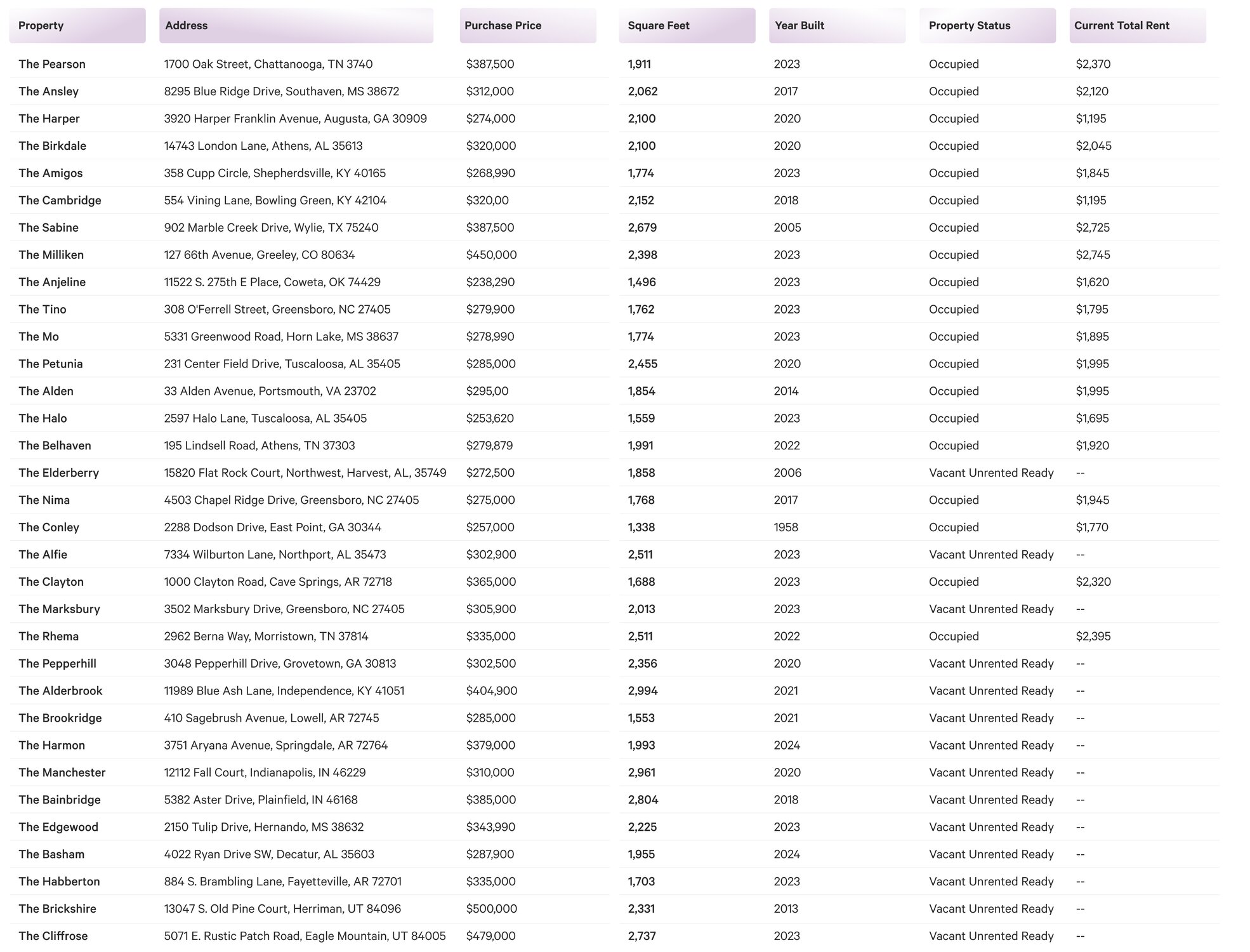

Summary of Fund Activities and Key Metrics

The Arrived Single Family Residential Fund was launched on November 29, 2023. In Q1 2024, the fund received $6.6M in investments, resulting in a total of $9.8M since launch at the end of November 2023 and 11,742 investors for an average AUM per investor of $833.

This funding has enabled us to accumulate a portfolio of 33 properties for a total purchase price of approximately $10.7 million.

Of the 33 properties owned by the Arrived Single Family Residential Fund:

- Stabilized properties: 20*

- Leased: 19

- Average lease term: 2 years

- Stabilized occupancy: 95%

- Leases signed at a premium: 74% with an average 5.5% premium

- Total markets: 18

*Arrived defines a stabilized property as one that has been leased or has been rent-ready for over 90 days.

Dividends and Share Price

During Q1 2024, the Arrived Single Family Residential Fund's net returns represented +0.7% for the quarter in combined dividends and share price appreciation. The Arrived Single Family Fund paid $65K in dividends and earned an annualized dividend of 4.0%.

The Fund's share price debuted at $10. Following our initial acquisitions in Q1 2024 and necessary adjustments, including fair value revisions and fee adjustments, the share price now stands at $9.97. This price will remain unchanged until our Q2 NAV/Share update.

The share price adjustment in Q1 2024 can be attributed to several factors inherent in the fund's initial operational phase. During an initial ramp-up stage, funds often take time to become stabilized. The Fund's income statement comprises revenue from rental income and expenses related to managing assets and operating the fund. With a significant portion of non-stabilized assets still vacant, property-related expenses outweigh property-related revenue, compounded by fund-related expenses that must be incurred.

This imbalance between revenue and expenses is typical for funds in their early stages. As the fund expands and its portfolio grows to support additional property-related expenses, this initial net loss trend is expected to diminish, eventually transitioning into profitability.

Additionally, property valuation increases totaling approximately $215k, based on automated valuation models and market assessments, were incorporated into the share price update. These adjustments are accompanied by amortization and adjustments of one-time recognized and forecasted fees and expenses, including offering, sourcing, and disposition fees.

Ultimately, the confluence of these factors contributed to the decrease in the share price by 0.34%, approximately $0.03, reflecting the fund's current operational dynamics and trajectory toward long-term growth and profitability.

Looking Ahead - Opportunities and Plans for 2024

We are excited about the opportunities that lie ahead for the Arrived Single Family Residential Fund. Over the coming months, several strategic initiatives are planned to enhance the Fund's performance further and maximize return potential.

We will continue to actively acquire properties in attractive markets, capitalizing on opportunities for growth and value creation. This strategy involves thorough market research and strategic decision-making to ensure each acquisition contributes positively to the Fund's overall performance.

We recognize the importance of streamlining processes to improve overall performance and optimize return potential. We are committed to enhancing the Fund’s operational efficiency. We also aim to expand our investor base, welcoming new investors who share our vision and desire for long-term wealth accumulation.

Looking forward, we expect that the properties acquired during this period will play a vital role in driving substantial returns, especially as interest rates are expected to come down.

We firmly believe in the power of patience and long-term planning, recognizing them as fundamental principles for achieving success in investing.