Welcome to Arrived’s Q1 2024 review! Let’s review the dividends and appreciation of the 358 Arrived properties operating during Q1 2024.

In Q1 2024, investors earned more than $1.1MM in dividend income, an increase of approximately 16% from Q4 2023. In total, 352 individual properties paid out dividends. In Q1 2024, single family residential properties earned an average annualized dividend of 3.8%. Vacation rental homes earned 3.4% on average. The Arrived Single Family Residential Fund earned an average annualized dividend of 4.0%.

Product Updates

Arrived has launched Cash Balance to pay dividends directly to an investor’s Arrived account. With the launch of this new feature, we’ve unlocked our ability to pay dividends monthly instead of quarterly — one of our most highly requested features from investors. As an Arrived investor, you’ll also have easy access to your Cash Balance to reinvest in new offerings (potentially creating more compound returns over time) or withdraw your dividends into your account anytime. Click here to learn more about Cash Balance.

In line with our commitment to transparency and accessibility, we've revamped our property pages to include a comprehensive property timeline for all single family residential properties and vacation rentals. Now, investors can track key property updates at a glance at the top of the Performance tab.

Arrived has also implemented two-factor authentication across all investor accounts. This crucial step strengthens our ability to better protect investor assets.

Dividends

Dividends earned can vary by investment. In Q1 2024, 315 individual single-family residential properties paid a dividend between 1.2% and 9.3%, with a 3.8% annualized average. 37 vacation rentals paid a dividend between 2% and 6.3%, with a 3.4% average. The Arrived Single Family Residential Fund earned an average dividend of 4.0%.

Read more about the Arrived Single Family Residential Fund performance in our Q1 2024 Summary here.

You can view the dividends for each individual property on our Historical Returns page.

The annualized dividend for each individual property is calculated by taking the Q1 dividend and extrapolating it out for an entire year. Building a diversified portfolio across multiple markets is a great strategy to minimize risk while getting exposure to different real estate markets and earning passive income.

The chart below shows the combined realized dividends and unrealized appreciation of single family residential properties and vacation properties.

It's evident that properties typically have lower total returns in the first six months because they have only received dividends and don't have an appreciation update yet. However, approximately half of the properties have positive returns from around six to fifteen months.

In the early stages of investing in a single family residential property, macroeconomic factors such as prevailing mortgage rates, the strategic use of leverage, and the prevailing market prices of homes can significantly impact initial total returns. For example, lower mortgage rates can stimulate demand and increase property values, while adding leverage can amplify returns but also heighten risk, and high home prices may delay the realization of profits. It's important to remember that real estate tends to perform best as a long-term investment, allowing investors to navigate through various market cycles and maximize returns.

This chart highlights the importance of diversification and dollar-cost averaging in the real estate market. Predicting the best-performing property in a cohort at IPO is challenging. Diversifying your portfolio through a combination of different single family residential properties, vacation homes, and funds like the Arrived Single Family Residential Fund can be an effective strategy for mitigating risk.

In Q1 2024, 17 properties were added to the Arrived Single Family Residential Fund. More than 11.7K investors have invested $9.8M in the fund since launch. The Arrived Single Family Fund paid $65K in dividends. The Arrived Single Family Residential Fund earned an average annualized dividend of 4.0% in Q1 2024.

Share Prices

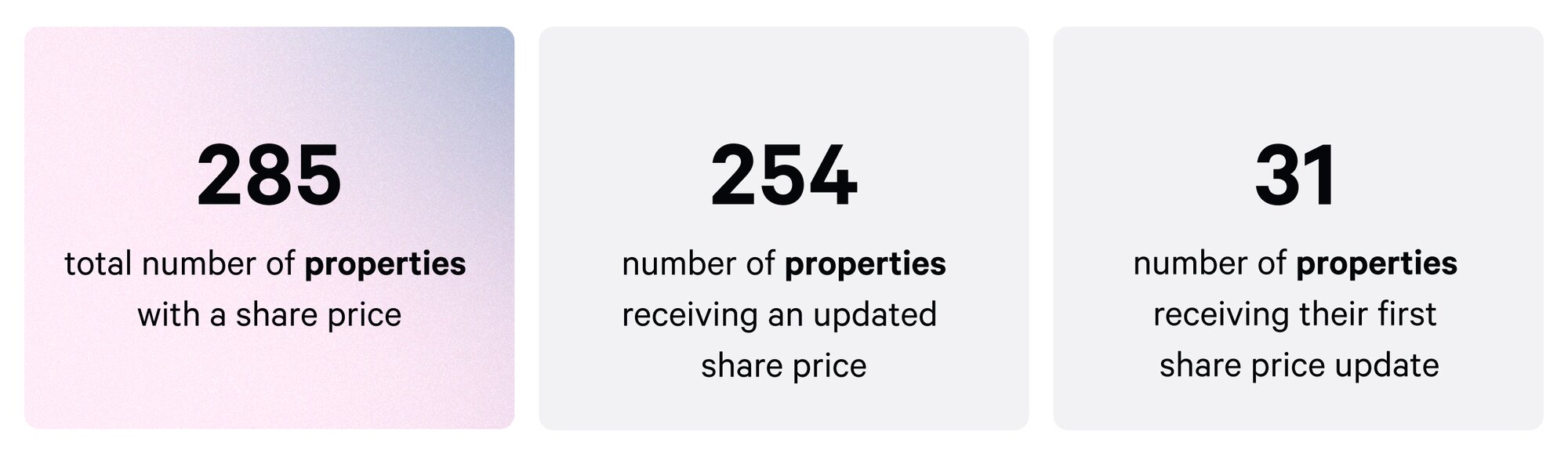

In Q1 2024, 285 Arrived properties have a share price. 254 operating properties received an updated share price, while 31 properties received their first share price update.

Share Prices are a way to see the value of your investment change over time, much like you would track a portfolio of stocks.

A property’s share price reflects both its value and its cash balance. Any actions that affect the cash balance will impact the share price. This could include revenue, vacancy, dividends paid, and different operating expenses. For IPOs, the share price is unrealized until the disposition of the property. You can learn more about how share prices are calculated in our FAQ.

Single Family Residential Property Share Prices

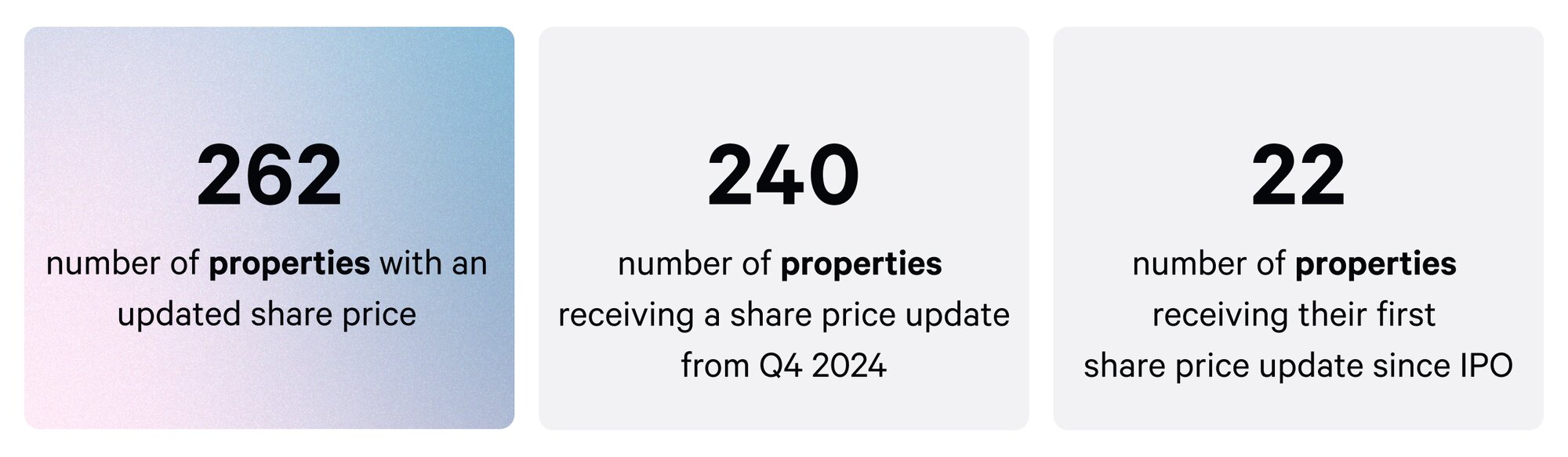

In Q1 2024, we updated the Share Prices for 262 single family residential properties, including 240 properties receiving an updated share price from 3 months ago and 22 properties receiving their first share price since their IPO 6-9 months ago. The Single Family Residential Fund also received its first valuation in Q1 2024.

For the 240 properties receiving an updated share price, the share price ranged between -15.9% and 13.5%. That resulted in an average share price change of -1.5% from Q4 2023 to Q1 2024.

For the 22 properties receiving a share price for the first time, share prices ranged between -6.4% and -0.2%. That resulted in an average share price change of -2.8% in Q4.

The share price range reflects the low, high, and average range for all Arrived single family residential properties. This range may reflect individual properties impacted by specific circumstances, such as eviction proceedings or significant maintenance issues affecting the property's cash flow.

Single family residential investors can view the performance of individual properties in their portfolio on their Portfolio Page. Investors can also view the offering history of all single family residential properties under the“Performance” section on the Property Page.

Below is the average Q1 single family residential share price categorized by the number of months owned for each property.

Vacation Rental Property Share Prices

In Q1 2024, we updated the Share Prices for 23 vacation rental properties, including 14 properties receiving an updated share price from 3 months ago and 9 properties receiving their first share price.

The average share price change for the 14 properties receiving an updated share price was -2.9%. The average share price for the 9 properties receiving a share price for the first time was -5.7%.

You can learn more about how vacation rental share prices differ in our FAQ.

The above-mentioned share price range may contain individual properties affected by specific circumstances, such as a shift to a new property management partner.

While share prices react to the current market in the short term, real estate performs best as a long-term investment, all while investors continue earning dividends through rental income.

*Share Prices for single family residential properties are updated six months after the initial property funding, using estimates provided by third-party sources. Vacation rental properties are updated 12+ months after initial funding and every quarter thereafter.

Understanding Negative Appreciation: Real Estate Is a Long-Term Investment

When considering rental share prices, it's crucial to understand the high initial costs and longer ramp-up time needed to start generating income, especially for vacation rentals. This often leads to an initial decrease in share price followed by a recovery period as the investment matures. This is because the share price reflects not only the property's value but also its cash balance, which is initially reduced by startup expenses.

This initial dip is evident in the Arrived Single Family Residential Fund. The Fund's share price debuted at $10. Following our initial acquisitions in Q1 2024 and necessary adjustments, including fair value revisions and fee adjustments, the share price now stands at $9.97. During Q1 2024, the Arrived Single Family Residential Fund's net returns represented +0.7% for the quarter in combined dividends and share price appreciation. The Arrived Single Family Fund paid $65K in dividends and earned an annualized dividend of 4.0%.

The Fund's early-stage operation contributes to a discrepancy between property appreciation and share prices. During this ramp-up stage, funds often operate at a net loss due to expenses outweighing revenue. With a significant portion of newly acquired assets still vacant, property-related expenses outweigh property-related revenue, compounded by fund-related expenses that must be incurred.

This imbalance between revenue and expenses is typical for funds in their early stages. As the fund expands and its portfolio grows to support additional property-related expenses, this initial net loss trend is expected to diminish, eventually transitioning into profitability. Read more about the current and future outlook of the Arrived Single Family Residential Fund in our Q1 2024 Summary here.

Operational Performance

Single Family Residential Stabilized Occupancy

Arrived closed Q1 2024 with a stabilized occupancy rate of 92%* for the single family residential properties in operation during the quarter. This was helped by 54 new leases signed in Q1. It’s also worth noting that the average term on these 54 leases was 21 months, and 72% leased above our forecasted rent.

*Stabilized Occupancy includes homes that are occupied or are 90+ days rent-ready from their initial improvements (single family residential properties only). A property may be removed from stabilized if significant impairment outside of the ordinary course of operations requires material action for an extended period.

Vacation Rental Performance

As of the end of Q1 2024, we have 36 bookable vacation rental properties, 3 of which became bookable during the quarter. Here are some highlights from the quarter for this asset class:

- $705,777 gross booking revenue across all operational vacation rentals in Q1*

- 25 total vacation rental markets as of Q1 2024

- Q1 2024 ended with an average rating of 4.9

- New market: Angelfire, New Mexico

*Our guest rating is a weighted average for all bookable vacation rentals from the property’s bookable date to the end of Q1 2024.

*These figures include only stabilized IPO properties. All figures are unaudited and subject to change.

In Q1 2024, 36 vacation rentals were in operation. The gross booking revenue and average guest rating for each rental are below. Gross booking revenue is reported before any deductions for the property management fee, operating expenses, and repairs and maintenance expenses.

Arrived Single Family Residential Fund Occupancy

Arrived closed Q1 2024 with a stabilized occupancy rate of 95%* for the single family residential properties in operation in the Arrived Single Family Residential Fund during the quarter. This was helped by 17 new leases signed in Q1. It’s also worth noting that the average term on these 17 leases was 24 months, and 74% leased above our forecasted rent.

Closing Thoughts By Arrived VP of Investments, Cameron Wu

Despite affordability challenges, we're continually impressed by the resilience of the residential real estate market. While sustained higher interest rates and persistent inflation have tempered expectations for rate reductions, home prices remain steady. This underscores the importance of strategic precision and market selectivity. We're focusing on areas with strong macroeconomic tailwinds such as population and job growth, and favorable tax schemes, aligning with our strongest convictions.

As we enter the peak season for long-term rentals, our leases are strategically structured to mostly expire between March and June, minimizing lease-up times and maximizing new rents. This positions us well to capitalize on seasonal demand for rentals. Additionally, our vacation rental portfolio is experiencing robust growth, boasting nearly 60% occupancy rates across our portfolio, with 11 properties managed internally by Arrived.

Our targeted approach and operational enhancements continue to create valuable opportunities for our investors. Despite challenges in the real estate landscape, we remain optimistic and committed to delivering excellent investments to Arrived.