We’re excited to introduce the Arrived Secondary Market—another step forward in our mission to make investing in the real estate sector more accessible and flexible for everyone. Starting in August, with additional trading windows in September and November 2025, investors will be able to buy and sell shares of rental properties and vacation rentals directly on the Arrived platform. Each window will expand the number of tradable properties, unlocking new ways to manage and optimize your portfolio.

What is the Arrived Secondary Market?

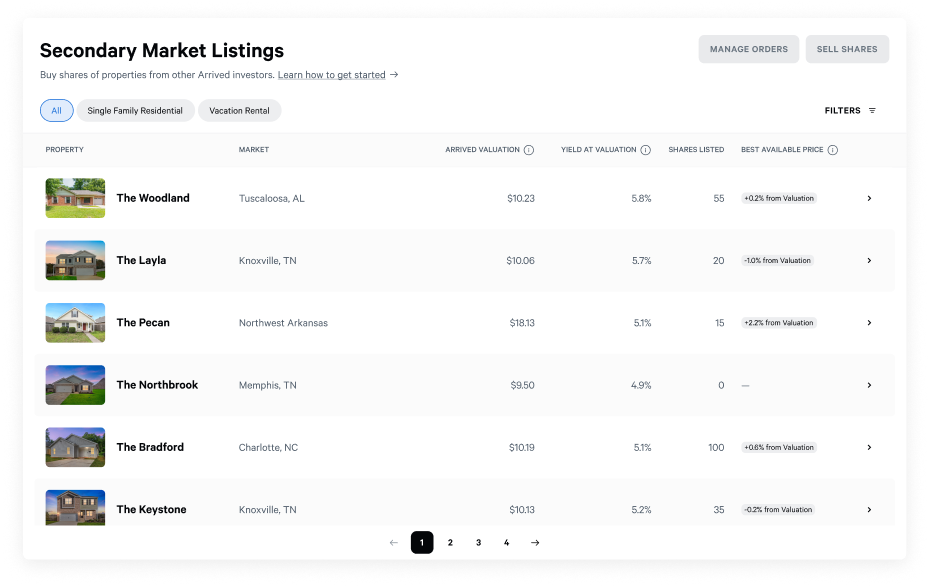

With the Arrived Secondary Market launch, investors will have the potential to access investments in 400+ rental properties across 60 cities—including single family residential homes like The Lierly and The Soapstone, or vacation rentals like The BeatBox and The Byers.

For those looking to exit an investment before the typical holding period ends, the secondary market provides an early opportunity to sell shares, offering an alternative path to liquidity* that was previously unavailable. Whether adjusting your portfolio strategy or responding to changing financial goals, this marketplace is designed to give investors more ways to manage and shape their real estate investments.

*Liquidity is not guaranteed. Liquidity only occurs when a buyer matches a seller.

Why it matters

Traditional real estate has always been challenging to purchase and even more difficult to sell. The Arrived Secondary Market introduces a new level of flexibility to investing in the real estate market, addressing a top request from investors seeking liquidity and expanded access to properties.

Here’s what makes it a game-changer:

- Quarterly liquidity – Investors will have the opportunity to buy & sell shares every quarter, offering more flexibility than traditional real estate investments.

- Access to missed opportunities – Investors can buy shares of properties they may have missed at the initial offering, unlocking more ways to diversify.

- The largest residential marketplace – With 400+ properties across 60+ cities, Arrived is building the most extensive marketplace of its kind.

By complementing the liquidity options available through Arrived’s Single Family Residential Fund, Seattle City Fund, and Private Credit Fund, the secondary market provides a peer-to-peer platform where investors can rebalance portfolios, shift allocations across markets, and gain exposure to previously unavailable properties. The market-driven pricing model allows investors to set their own buy and sell prices, ensuring transparency. As one of the most requested features, the secondary market allows investors to adjust their strategies over time, creating additional opportunities for long-term portfolio growth.

How it works

- Properties become eligible for trading following their first Arrived Valuation.

- The market opens for a one-week trading window each quarter.

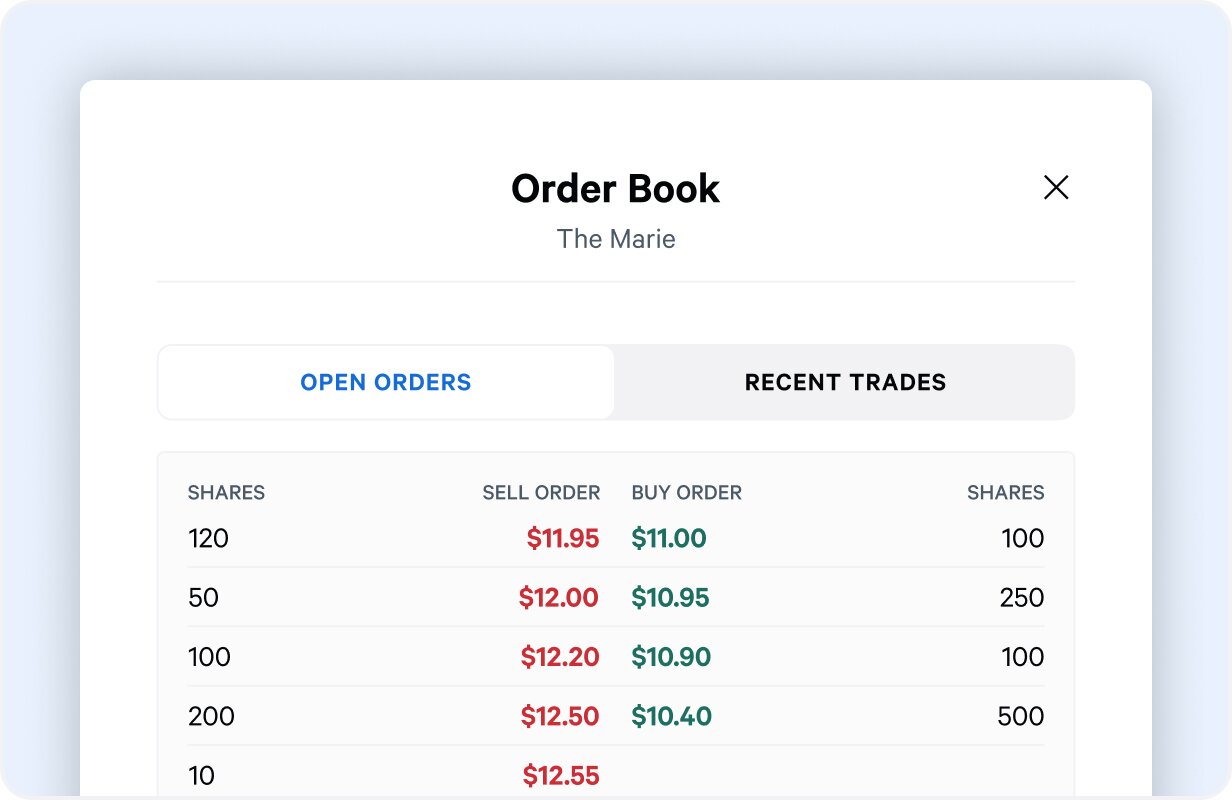

- Investors can place limit orders, setting their preferred buy or sell price.

- Orders are matched in real-time when buy and sell prices align.

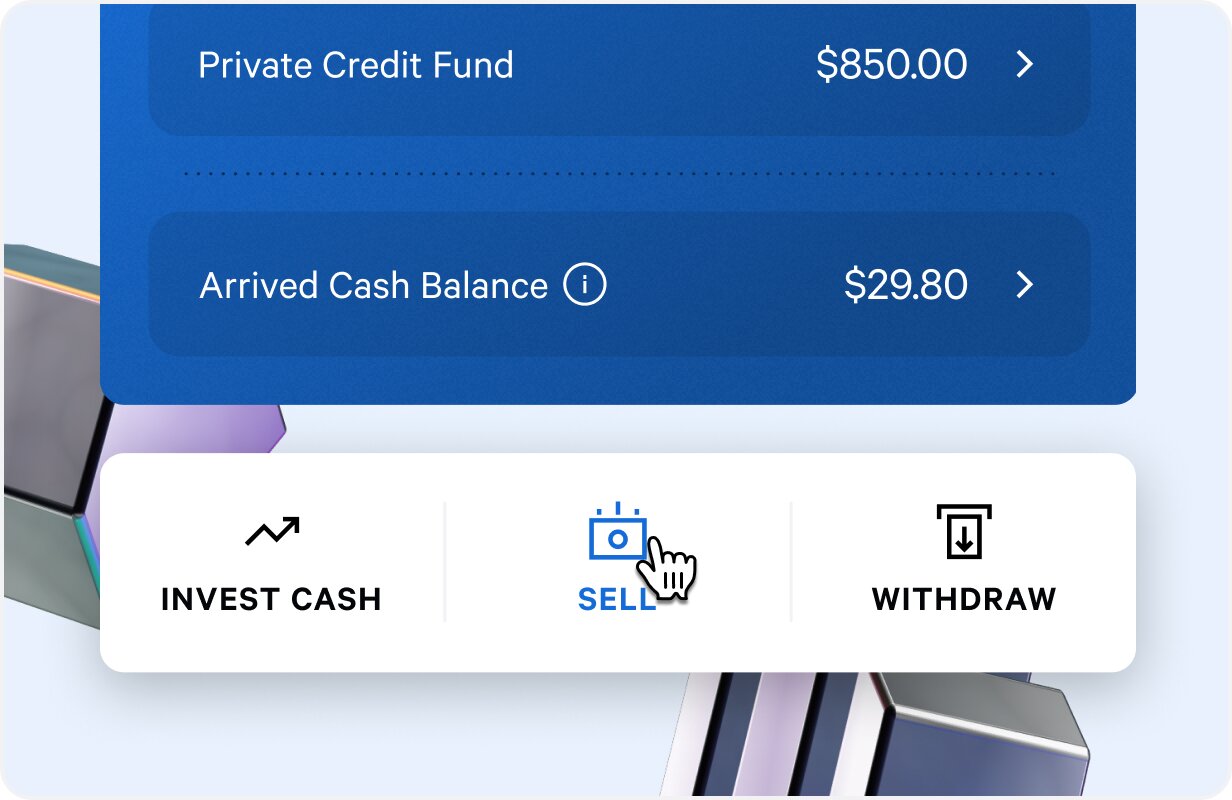

- Transactions are processed seamlessly with your connected bank account or existing Arrived cash balance.

When does the Secondary Market launch?

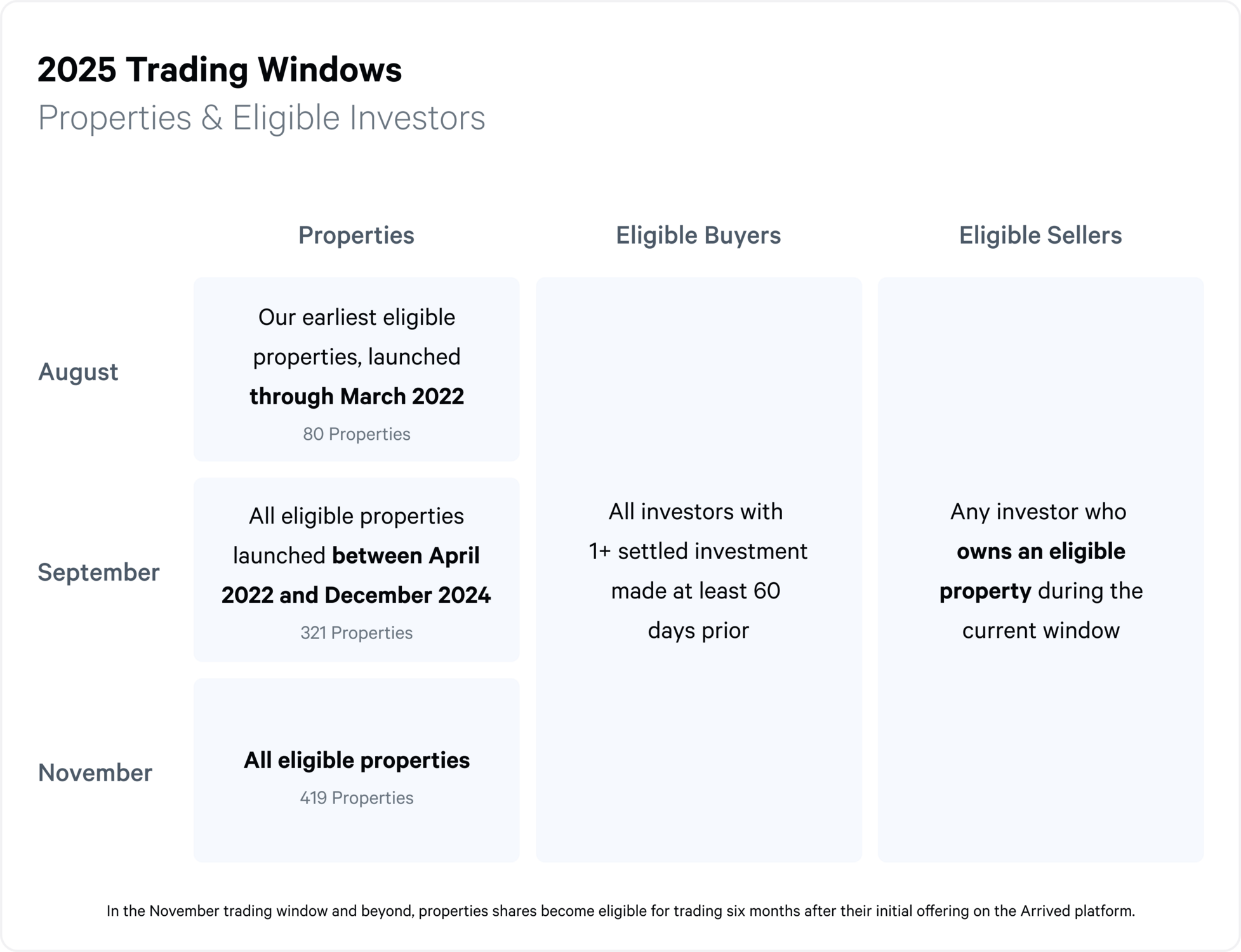

The secondary market will launch in phases, starting in August 2025, with a gradual expansion of the properties eligible for trading. This rollout is designed to ensure a smooth experience for all investors. Trading windows will then open quarterly in February, May, August, and November of 2026.

Key dates for the secondary market launch:

- August 2025 – All eligible investors can buy shares. Selling is limited to properties that were launched through March 2022.

- September 2025 – All eligible investors can buy shares. Selling expands to include properties launched between April 2022 and December 2024.

- November 2025 – Eligible investors can buy and sell shares of all eligible properties.

Starting in 2026, the secondary market will operate on a quarterly trading schedule, with trading windows scheduled for February, May, August, and November.

FAQ

What is the Arrived Secondary Market?

Who can buy & sell on the secondary market?

How does the Arrived Secondary Market work?

When will the secondary market be available?

What is the difference between the Arrived Secondary Market and the Arrived redemption program?

Are there any fees associated with buying or selling shares?

What will a normal trading schedule look like?

Can I still be successful on Arrived without using the secondary market?