Welcome to Arrived’s Q4 2023 review! Let’s review the dividends and appreciation of the 324 Arrived properties operating during Q4 2023.

In Q4 2023, investors earned more than $972,000 in dividend income, an increase of approximately $82,000 from Q3 2023. In total, 324 properties paid out dividends. In Q4 2023, single family residential properties earned 3.9% on average. Vacation rental homes earned 3.5% on average.

*Calculated by dividing the latest dividend for a single share this quarter by the $10 initial offering price and multiplying the result by 4, the number of quarters in a year.

*As of Q4 2023, 358 properties have IPO’d. Of these, 324 properties are operational, paying at least one dividend by the end of Q4 2023. Of the 324 operational properties, 20 are not receiving dividends this quarter. Dividend ranges do not include properties that did not pay out a dividend. Learn more about how dividend amounts are calculated.

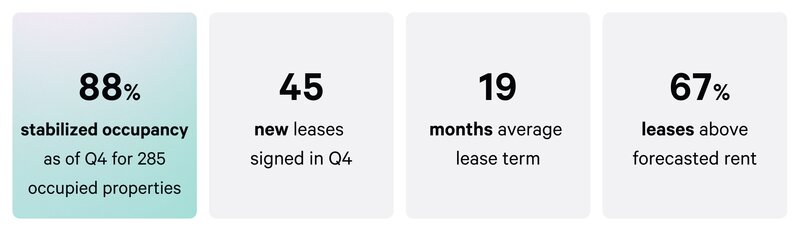

Occupancy

Arrived closed Q4 2023 with a stabilized occupancy rate of 88%* for the single family residential properties in operation during the quarter – this was helped by 45 new leases signed in Q4. It’s also worth noting that the average term on these 45 leases was 19 months, and 67% leased above our forecasted rent.

*Stabilized Occupancy includes homes that are occupied or are 90+ days rent-ready from their initial improvements (single family residential properties only). A property may be removed from stabilized if significant impairment outside of the ordinary course of operations requires material action for an extended period.

Dividends

Dividends earned can vary by investment. In Q4 2023, single family residential properties earned between 1.2% and 9.1%, with a 3.9% average. Vacation rentals averaged between 2.0% and 6.0%, with a 3.5% average.

*The dividend range does not include the 20 properties not receiving a quarterly dividend due to specific circumstances, such as eviction proceedings, significant maintenance issues impacting the property's cash flow, or not yet booking-ready. Any operating income for these properties will be added to the property's cash reserves and distributed at a later dividend date. See the individual property pages for updates on the current status.

You can view the dividends for each property on our Historical Returns page.

The annualized dividend for each property is calculated by taking the Q4 dividend and extrapolating it out for an entire year.

Building a diversified portfolio across markets is a great strategy to minimize risk while getting exposure to different real estate markets and earn passive income.

Below is a visualization of the current annualized dividend rate calculated as a function of the initial $10 share price across all of our properties mapped over the number of months owned.

The chart shows the combined realized dividends and unrealized appreciation of single family residential properties and vacation properties.

It's evident that in the first six months, properties have lower total returns because they have only received dividends and don't have an appreciation update yet. However, approximately half of the properties have positive returns from around six to fifteen months.

This chart highlights the importance of diversification and dollar-cost averaging in the real estate market. Predicting the best-performing property in a cohort at IPO is challenging, so diversifying and buying shares of different properties can be an impactful investment strategy.

Monthly Dividends

Arrived has launched Arrived Wallet to pay dividends directly to an investor’s Arrived account. With the launch of this new feature, we’ve unlocked our ability to pay dividends monthly instead of quarterly — one of our most highly requested features from investors. As an Arrived investor, you’ll also have easy access to your Arrived Wallet to reinvest in new offerings (potentially creating more compound returns over time) or withdraw your dividends into your personal account anytime.

Starting in February, we expect dividend payouts to occur each month on the 25th. If the 25th falls on a weekend, dividend payouts will occur on the first following business day.

Dividends will be distributed to your Arrived Wallet. Click here to learn more about Arrived Wallet.

Single Family Residential Fund

In Q4 2023, Arrived launched the Arrived Single Family Residential Fund, offering the same high-quality properties while enjoying an always-available investment experience, one-click diversification, and access to liquidity.

In Q4 2023, 12 properties were added to the Arrived Single Family Residential Fund. More than 4,600 investors invested $4 million in the fund.

Investors who have invested in the Single Family Residential Fund by December 31 will receive their first dividend on February 25. We expect to pay out dividends for this fund monthly, with subsequent dividends paid out at the end of each month. Please note that depending on the timing of your investment, it may take up to 60 days to receive your first dividend.

We expect that the second monthly dividend will be paid on March 25. To qualify for this dividend, investors must invest by January 31.

Share Prices and the Current Market

Share Prices are a way to see the value of your investment change over time, much like you would track a portfolio of stocks.

Single Family Residential Property Share Prices

In Q4 2023, we updated the Share Prices for 240 properties, including 205 properties receiving an updated share price from 3 months ago and 49 properties receiving their first share price since their IPO 6-9 months ago.

For the 205 properties receiving an updated share price, share price changes ranged between -17.9% and 14.1%. That resulted in an average share price change of -2.0% from Q3 to Q4.

For the 35 properties receiving a share price for the first time, share prices ranged between -17.8% and 2.9%. That resulted in an average share price change of -3.1% in Q4.

The share price range reflects the low, high, and average range for all Arrived single family residential properties. This range may reflect individual properties impacted by specific circumstances, such as eviction proceedings or significant maintenance issues impacting the property's cash flow.

Single family residential investors can view the performance of individual properties in their portfolio on their Portfolio Page. Investors can also view the offering history of all single family residential properties under the

“Performance” section on the Property Page.

Below is the average Q4 single family residential share price categorized by the number of months owned for each property.

Vacation Rental Property Share Prices

In Q4 2023, 14 properties are receiving their first share price since their IPO 12-15 months ago.

For the 14 properties receiving a share price for the first time, share prices ranged between -16.8% and 9.7%. That resulted in an average share price change of -6.5% in Q4.

The share price range here reflects the low, high, and average range for all Arrived vacation rental properties.

When analyzing vacation rental share prices, it is important to remember that they require high initial costs to start operations and a significantly longer ramp-up time to start generating income. This may lead to a common trend of initial share price reduction followed by a recuperation period over the lifetime of the investment. This is because the share price of each property takes into account not only its property value but also its cash balance, which is reduced by the initial expenses.

Below, you can see a typical investment J-curve that graphs the initial investment, leading to a loss followed by improvement over time. A vacation rental can show a steeper initial decline compared to single family residential properties. You can learn more in our FAQ about how vacation rental share prices are different.

The above-mentioned share price range may contain individual properties affected by specific circumstances, such as a shift to a new property management partner. Arrived works with property management partners to provide on-the-ground services for some vacation rentals. While we always ensure that our PMs comply with the highest standards, there may be times when we need to transition to a new partner. In Q3 2023, Arrived took the strategic decision to switch to a new PM for some of our vacation rental properties. You can find more information about this transition here.

While share prices react to the current market in the short term, real estate performs best as a long-term investment, all while investors continue earning dividends through rental income.

*Share Prices for single family residential properties are updated six months after the initial property funding, using estimates provided by third-party sources. Vacation rental properties are updated 12+ months after initial funding and every quarter thereafter.

Share Price Estimate Updates

We're making our investment portfolio more transparent and informative for investors by adding a new column showing estimated high and low share prices. These estimates are intended to provide a higher degree of insight into what we expect your shares to be worth if we were to sell the property today. These estimates are determined by adjusting the property value estimate — a crucial factor in our share price model — to see how it influences the overall Share Price. We use historical appreciation data for properties in specific zip codes to establish the basis for varying this property value input. If the historical appreciation is below 4.5% per year, we default to using 4.5%, which is the 20-year national average.

For instance, if a property is valued at $100,000 and its zip code has a 20-year historical appreciation of 6%, we adjust the property values to $103,000 (+3%) and $97,000 (-3%) in the Share Price model to provide the high and low estimates of Share Price at a given time. The resulting Share Price outputs are what now appear in the Share Price low and high columns.

Vacation Rental Performance

As of the end of Q4 2023, we have 36 bookable vacation rental properties, 3 of which became bookable during the quarter. Here are some highlights from the quarter for this asset class:

- $603K+ gross booking revenue across all operational vacation rentals in Q4*

- 20 total vacation rental markets as of Q4 2023

- Q4 2023 ended with 477 ratings and an average rating of 4.88

- New markets: Weaverville and Athens

*Our guest rating is a weighted average for all bookable vacation rentals from the property’s bookable date to the end of Q4 2023.

*These figures include only stabilized IPO properties. All figures are unaudited and subject to change.

In Q4 2023, there were 36 vacation rentals in operation. The gross booking revenue and average guest rating for each rental are below. Gross booking revenue is reported before any deductions for the property management fee, operating expenses, and repairs and maintenance expenses.

Closing Thoughts By Arrived VP of Investments, Cameron Wu

2023 witnessed substantial shifts in demand and supply dynamics for popular vacation rental sites like Airbnb and VRBO. While the demand grew, the supply side also experienced a surge, indicating strong interest from investors and vacationers.

We gained a lot of insights into the dynamic vacation rental market over the last year. Notably, there is a unique ramp-up time associated with this industry. Unlike traditional single-family residences, vacation rentals demand substantial upfront capital investment and time to complete build-outs, averaging 3-5 months. To improve lifetime profitability, our strategy prioritizes occupancy and a high volume of 5-star reviews over market pricing during our initial ramp phase, aiming for potential stabilization within two years compared to the industry average of three years.

Our optimization strategies involve collecting a high count of positive reviews, securing Superhost and Guest Favorite tags, and pricing to maintain consistent occupancy. Acknowledging the critical role of property managers, we have strategically consolidated properties with the best-performing partners — including our in-house management service — achieving Superhost status within one month of operation and a 4.94 host rating with over 100 reviews.

Looking forward, home loan interest rates are potentially coming down in 2024. After a year marked by historically high rates, downward trends could change the dynamic in the real estate market and lead to a shift in homebuying sentiment. However, many homeowners have deferred selling their property, so an increase in supply could dampen expectations for home price appreciation. We’re keeping up with all of the macro trends so we can continue to deliver great investment properties to Arrived investors.